There are two misconceptions regarding PE multiple among the investors which makes them to choose wrong stocks. This blog post discusses about those two common misconceptions. Let's get into the topic.

PE Multiple Misconception 1

Comparing the Price/Earnings Ratio is the same thing as comparing the Profit Growth Rate.

Let us take the shares of two companies 'A' and 'B' as an example. Suppose company 'A' stock trades at P/E of 15x and company 'B' stock trades at 50x.

Let us also assume that the profits of these two companies are expected to increase by 10%.

Given the above information, an investor would say that out of these two companies with similar profit growth, Company 'B' stock is trading at a higher P/E multiple and is not investment friendly, while Company 'A' stock which is trading at a lower P/E multiple is suitable for investment.

If you ask if this is the right decision, my answer is that this is a false conclusion.

This is because the P/E multiple does not take into account how efficiently the capital (invested money) is used in a company (capital efficiency).

Intrinsic value of a company's stock is defined as the present value of the free cash flow that the company will receive (generate) in the future.

This free cash flow is not based solely on how much growth the company is experiencing. It is formed based on how efficiently the company utilizes the capital that is tied up in it.

In the above example, let us assume that company 'A' has a return on capital employed (RoCE) of 10 percent and company 'B' has a return on capital employed (RoCE) of 40 percent.

In this case, the capital of company 'A' will be Rs.1,000 (Rs.100/10%) and the capital of company 'B' will be Rs.250 (Rs.100/40%).

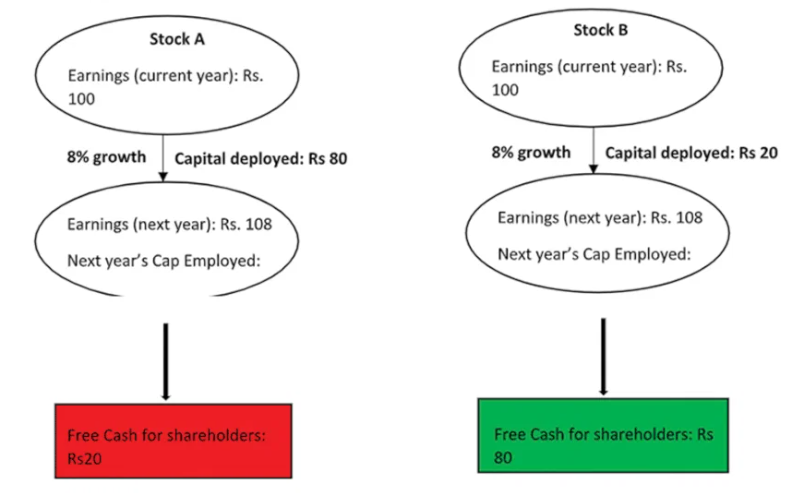

Company 'A' will have to reinvest Rs.80 (Rs.8/10%) for an 8% increase in earnings next year. This means that the company can achieve an income growth of 8% only if it reinvests 80 percent of the current year's profit (Rs.100 x 80% = Rs.80).

Meanwhile, Company 'B' can achieve 8% growth by reinvesting just Rs.20 (Rs.8/40%). That is, by investing 20 percent of the current year's profit (Rs.100 x 20% = Rs.20), the company can achieve 8% income growth.

That is, at 8% profit growth Company 'A' will generate a free cash flow of Rs.20. Meanwhile, at 8% profit growth Company 'B' will generate a cash flow of Rs.80. That is, company 'B' will generate four times more cash flow than company 'A'.

Because of the difference in capital efficiency between the two companies, company 'B' consistently generates four times more cash flow every year than company 'A' at the same growth rate of 8%.

All other things being equal between the two firms, since firm 'A' has four times the capacity to use capital (i.e., one-fourth the amount of capital itself to generate the same amount of cash flow) than firm 'B', firm 'B' Company's P/E multiple should be four times the P/E multiple of company 'A'.

Why you ask? The denominator in the formula to calculate the P/E ratio of these two companies is the number of earnings per share.

At the same time, company 'A' generates one fourth more cash flow than company 'B' for the same earnings. Therefore, the intrinsic value of company 'B' should be four times that of company 'A'.

This is why if the P/E value of company 'A' is 15x, the P/E value of company 'B' should be 60x. That's why when company 'B' trades at 50x, we say that company 'B' is priced less than company 'A', which trades at 15 P/E.

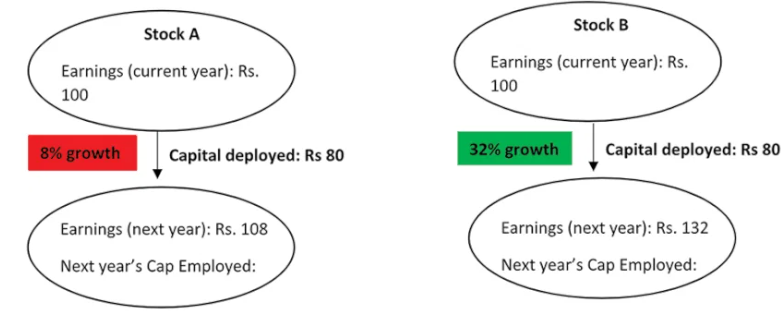

Let's change our example a bit. What will happen if company 'B' reinvests Rs 80 as much as company 'A' should?

Company 'A' will experience four times higher growth rate. At the same time Company 'A' will not have the means to make the necessary investment to achieve the same level of growth.

Borrowing and investing will be the way for company 'A' to make a profit. Hence, Company 'B' has a higher P/E multiple than Company 'A'.

If company 'B' continues to invest more every year and generate more free cash flow (due to higher leverage) and reinvest it, there is a chance that its P/E multiple will exceed 4x that of 'A'.

Because wouldn't the rapid cash flow growth that Company B is experiencing lead to even higher cash flow generation in the future?

PE Multiple Misconception 2

The P/E multiple will converge to the mean over time even as investment efficiency increases (mean reversion)

The ability to use investment is not only a matter of comparison between firms operating in an industry. One should also look at the measurement of how the same company is performing at different periods.

That is, it is like making a measurement of how a company's capital management skills were five years ago and how they are now.

A company must increase its ability to consistently use its capital through one or more of the following activities: high asset turnover (i.e., reducing investment required for expansion), reducing working capital requirements through the introduction of technology in the supply chain, and increasing bargaining power with customers and suppliers. Will try.

Free cash flow will continue to increase as leverage continues to increase.

Because of this, the company's historical P/E (Price to Earnings) and P/B (Price to Book Value) ratios and today's P/E and P/B ratios will be quite different.

For an investor, a company's free cash flow should be analyzed and compared to what causes it to increase.

What if the company used the above techniques to increase capital utilization (such as shortening the working capital cycle) and operate more smoothly over the next 20 years? Also, what if the firm also has the ability to set the price of its product?

Profits will increase smoothly and free cash flow will also increase. Investors should invest in companies with such characteristics.

It needs to look at cash flow, not growth in value of assets or growth in profits.

If a company's free cash flow growth is higher than its earnings growth, comparing it on a P/E basis with another company that does not have such growth would be a false comparison.

This is because the P/E multiple of such companies is very high as long as the free cash flow is higher than the earnings.